The Average Purchase Method

To be successful in investing, you need to buy low and sell high

However, it is almost impossible to predict the right time to invest when markets rise and fall every day. Indeed, very few investors manage to choose the right time to buy and sell an investment.

There is, however, a way to take advantage of the ups and downs of the market without having to choose the right time to buy or sell. This is the average purchase method.

The Average Purchase Method consists of investing a fixed amount at regular intervals regardless of market conditions.

Investing a lump sum means investing a larger amount of money in one fell swoop.

Market synchronization refers to the attempt to predict the future direction of the markets and try to take advantage of the right prediction

Although the average purchase method has been a proven method by generations of savers, it is impossible to know whether the market will increase or decrease over a given period. The average purchase method helps to remove emotions from the investment decision. It removes market synchronization from the investment decision.

Three steps to consider

1 –Start Early.

The more your investment time frame is long, the more your capital will grow. The market tends to grow over time, so you will want to start saving as soon as possible to enjoy it.

2 –Do Not Focus on Unit Prices.

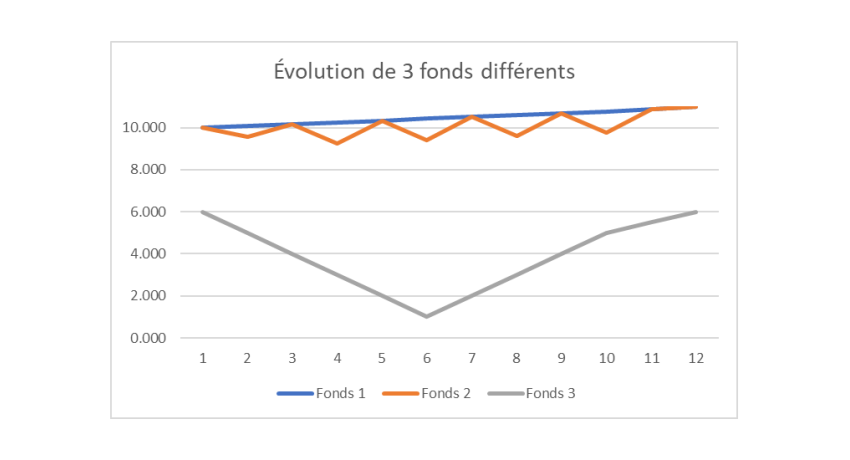

It is better to ignore short-term fluctuations in the price of different funds. Instead, it would be better to focus on the periodic accumulation of multiple units and keep an eye on your long-term goals. In case of a drop in prices, you can accumulate more units at a lower cost.

3 –Prepare for Market Fluctuations.

The Average Purchasing Method is a way to remove emotions from the investment decision and avoid the temptation to synchronize markets by making periodic investments. Do not forget to take a long-term perspective and focus on your long-term savings goals, even in a bear market.

The Net Result

The Average Purchase Method is a regular commitment to invest first, despite market fluctuations. This is a disciplined savings strategy that makes sense to many investors because it removes assumptions and emotions from the investment decision. An advisor can help you set up an investment plan involving regular contributions that make sense for your situation. An advisor can also help you control and rebalance your investments when necessary to help you avoid selling at a low price and buying at a high price.

Take Action

The best time to act is now.

Do not wait any longer, book an appointment now!